Extended Term Insurance Policy Meaning

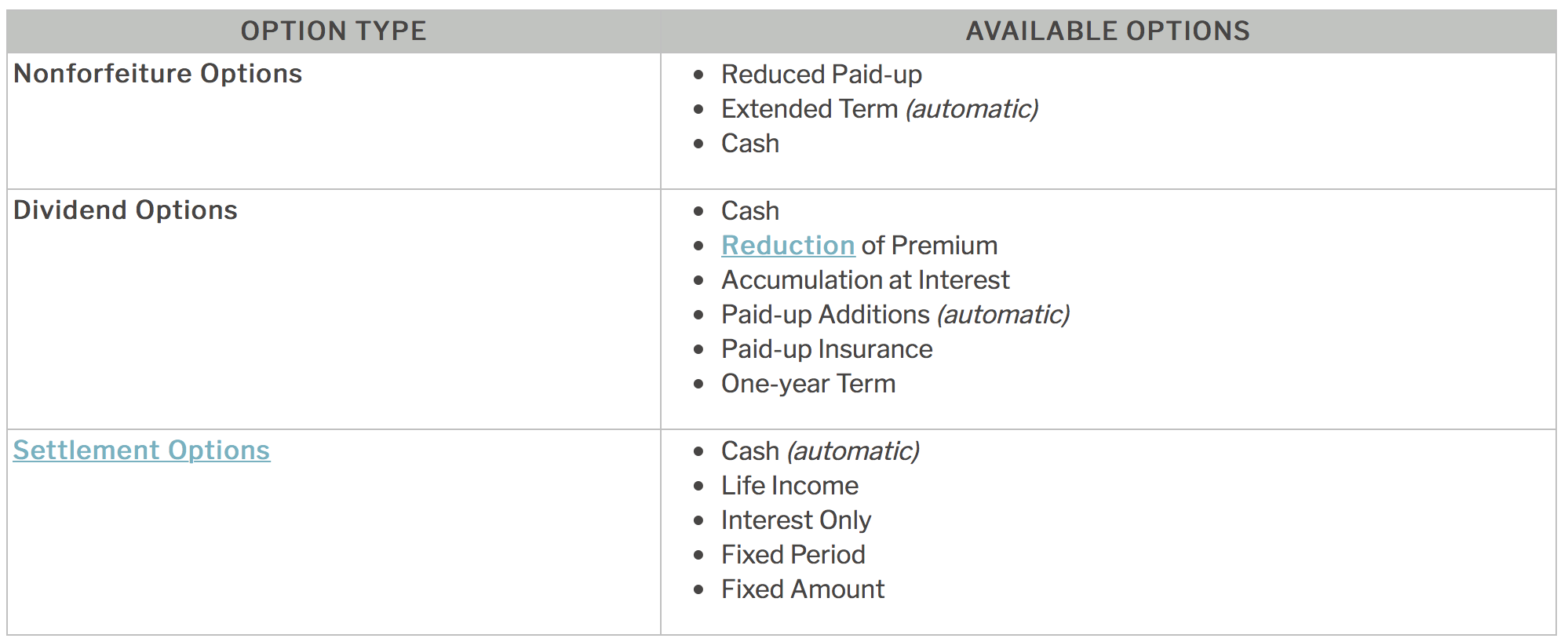

Noun life insurance in which a policyholder ceases to pay the premiums but keeps the full amount of the policy in force for whatever term the cash value permits. Definition Extended Term Insurance a nonforfeiture provision in a whole life policy that uses cash value to purchase term insurance equal to the existing amount of life insurance.

How Does Whole Life Insurance Work Costs Types Faqs

Extended term life insurance is coverage that is provided by the cash value in a life insurance policy.

Extended term insurance policy meaning. Extended term insurance is the default non-forfeiture options. Extended term insurance is a type of life insurance in which a policyholder can continue receiving coverage without paying premiums. The policy is usually a whole life policy but can originate from other cash value plans.

This means after the defined term length your coverage will expire. The equity you built is used to purchase a term policy that equals the number of years you paid premiums. The new policy would be purchased with the cash value you had built in your old life insurance plan.

Not The Same as Extended Coverage This is not to be confused with extended coverage a term used in the property insurance business. Extended term insurance is a type of life insurance that is designed to make whole life insurance more attractive. Extended-term insurance is often the default non-forfeiture option.

An extended term insurance nonforfeiture option would allow you to purchase term life insurance with a death benefit equal to that of the original whole life policy. Life insurance in which a policyholder ceases to pay the premiums but keeps the full amount of the policy in force for whatever term the cash value permits Most material 2005 1997 1991 by Penguin Random House LLC. Extended coverage is a term used in the property insurance business.

Here is an example. EXTENDED TERM INSURANCE OPTION. An option provided in some policies to continue the insurance for a particular insured amount as per the policy condition as term insurance.

You have a 100000 whole life policy that has built up some cash value. If the insured dies during the time period specified in a term. Extended term insurance is life insurance is a life insurance policy where the policy holder stops paying the premiums but still has the full amount of the policy in effect for whatever term the cash value permits.

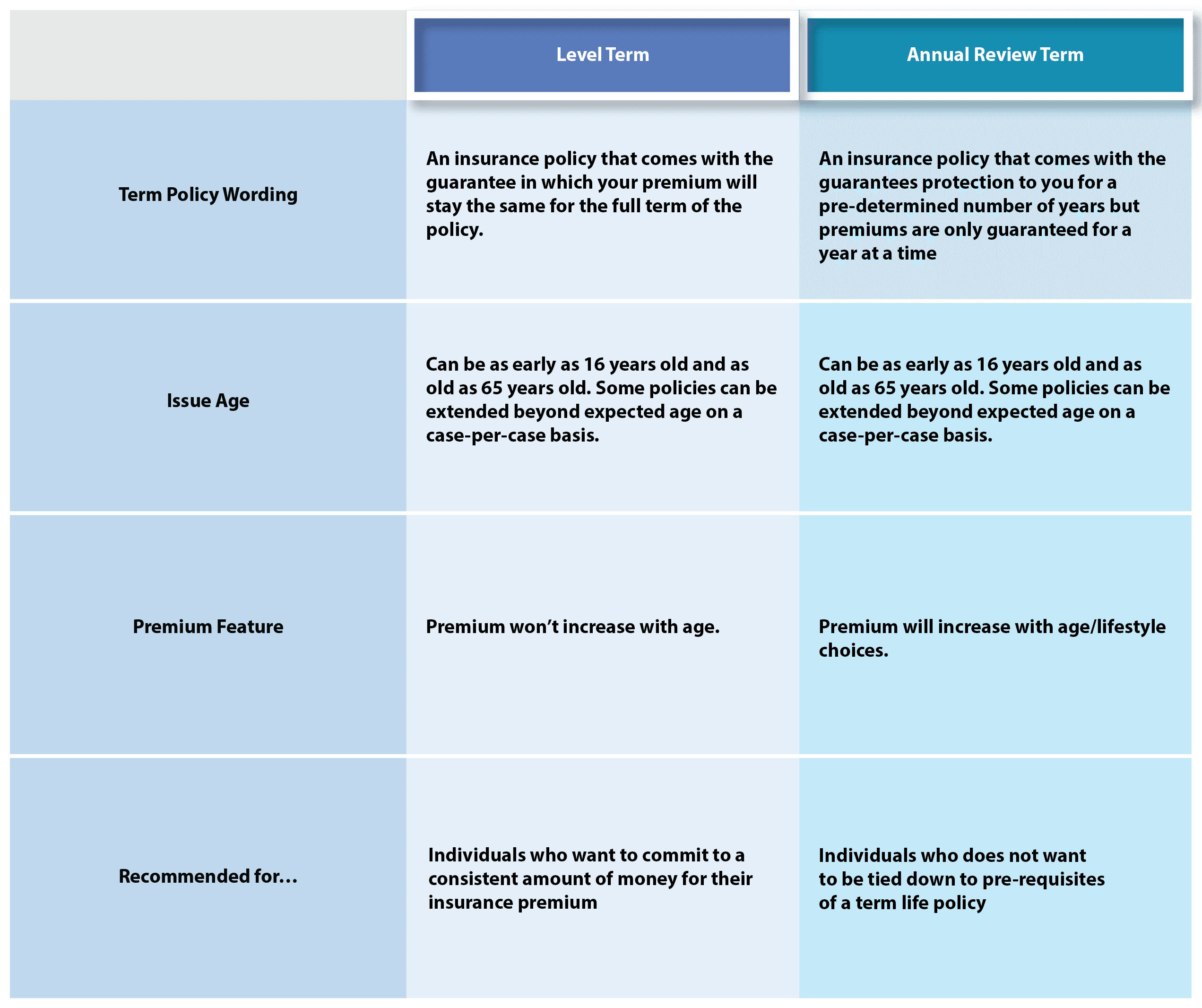

With the extended term insurance the face amount of the policy stays the same but it is flipped to an extended term insurance policy. When you purchase a whole life insurance policy part of the premiums that you pay are going to go towards accumulating a cash balance. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years.

Term life insurance offers coverage for a distinct period of time. En espaol The phrase long-term care refers to the help that people with chronic illnesses disabilities or other conditions need on a daily basis over an extended period of time. Modified entries 2019 by Penguin Random House LLC and HarperCollins Publishers Ltd You may also like.

The feature primarily seeks to help those who find themselves in a situation where the whole life premium is no longer affordable. A policy provision that provides the option of continuing the existing amount of insurance as term insurance for as long a. An extended coverage endorsement EC was a common extension of property insurance beyond coverage for fire and lightning.

Term life coverage is a useful way to keep premium costs down while you are younger and healthier. All insurance policies have exclusions for specific causes of loss also called perils that are not covered by the insurance company. Buying a long-term care insurance policy can be expensive but there are steps you can take to make it more affordable and flexible.

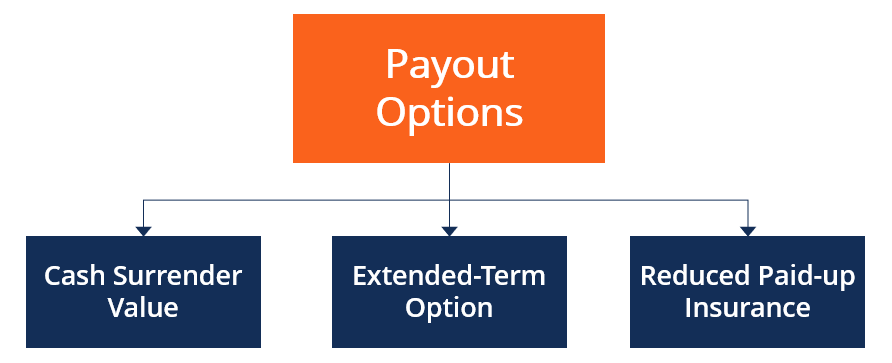

Extended term insurance is a nonforfeiture option on a whole life policy that uses the policys cash value to buy term insurance for the current whole life death benefit for a specified period of time. When a policy owner wants to stop paying required premiums it is one of the alternatives to surrendering the coverage for its cash value. An Extended Term Option is one of the standard nonforfeiture options in cash value policies.

With extended term insurance the face amount of the policy stays the same but it is flipped to an extended-term insurance. Here are the basics of extended term life insurance and how it works. Check out these sample rates from Allstate to get a sense of the cost for a 10-year term with 250000 in benefit.

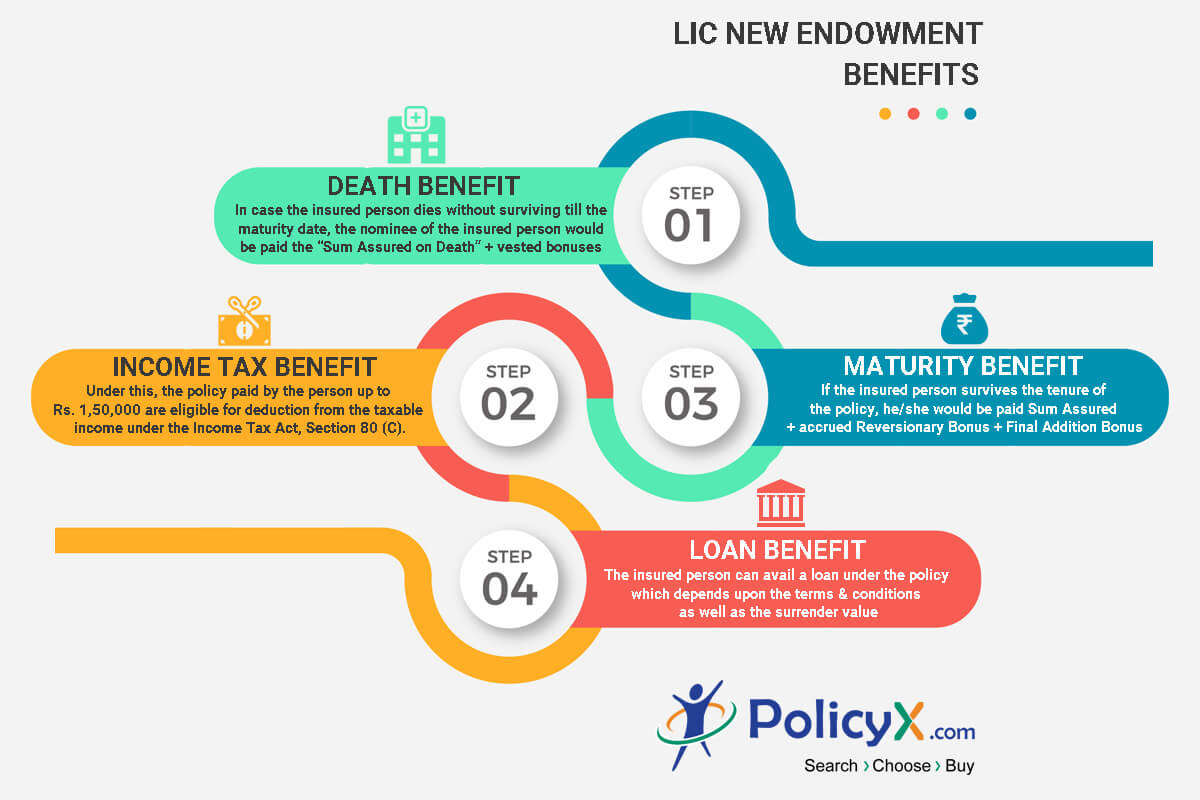

Lic New Endowment Plan 914 Online Reviews Features And Benefits

Decreasing Life Insurance Life Cover Legal General

Term Insurance Till What Age Learn Here

Nonforfeiture Clause Overview How It Works Payout Options

/insurance-life-protect-help-secure-care-1576403-pxhere.com-015a0a012f484af2bfe5a897031015a2.jpg)

Key Person Insurance Definition

What Is Term Insurance Term Insurance Definition Meaningaegon Life Blog Read All About Insurance Investing

Term Plan With Return Of Premium Trop 2021 Policybazaar

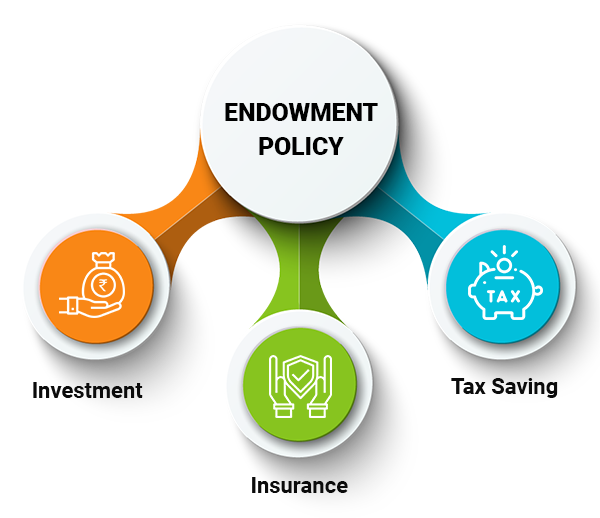

Endowment Policy Compare Best Endowment Plans Online

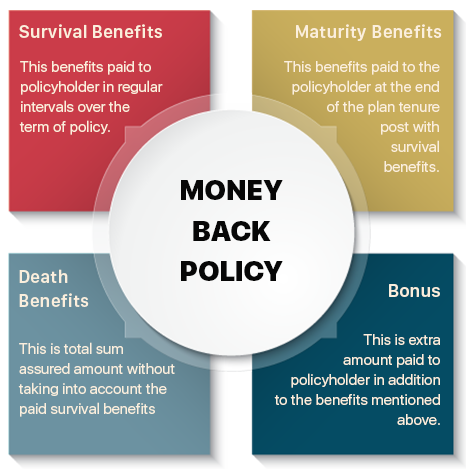

Money Back Policy Compare Money Back Plans Features Reviews

The Difference Between Short Long Term Disability Insurance

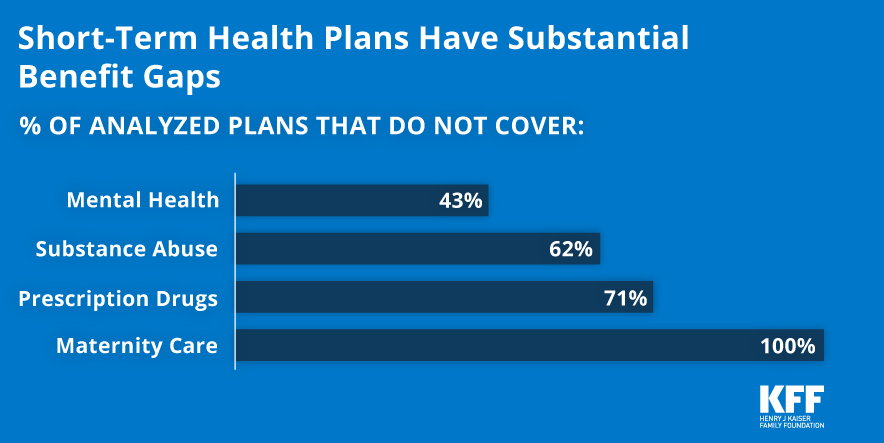

Short Term Health Insurance Plans Unitedhealthone

Policy Provisions Options And Other Features Flashcards Chegg Com

Best Term Life Insurance Policies In Malaysia 2021 Compare And Buy Online

Term Plan With Return Of Premium Trop 2021 Policybazaar

Best Term Life Insurance Policies In Malaysia 2021 Compare And Buy Online

Term Vs Whole Life Insurance Policygenius

What Is Sum Assured Max Life Insurance

Guide To Whole Life Insurance For 2021 Forbes Advisor

Understanding Short Term Limited Duration Health Insurance Kff

Post a Comment for "Extended Term Insurance Policy Meaning"