What Is Face Value Mean On A Life Insurance Policy

Face value is calculated by adding the death benefit with any rider benefits and subtracting any loans youve taken on the. Both the cash value and face value are different in terms of how their monetary amounts are determined.

17 Best Life Insurance Companies Of August 2021 Money

The death benefit is the amount that is actually paid to the beneficiary when death occurs.

What is face value mean on a life insurance policy. What Happens When You Pass Away. It is the amount that will be paid out at the death of the insured. This face amount is transferred at death to the beneficiaries of the policy with no income tax.

Frequently asked and often misunderstood the face amount of life insurance is the initial amount of financial protection listed on a life insurance policy. The life insurance face value vs. Face value is the.

The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your beneficiaries when you pass away. The face value of the policy is the death benefit that it provides. In other cases the life insurance may be kept effective permanently but at a lower policy amount.

This is the minimum that the beneficiary would receive from the policy as long as you dont have an outstanding loan against a. Cash value conversation can feel a little confusing especially since these two policy components are so similarly. Within your policy it is officially denoted as the death benefit.

The face value of life insurance is how much your policy is worth and more importantly how much life insurance money is paid out when the policyholder dies. Face value is different from cash value which is the amount you receive when you surrender your policy if you have a permanent type of life insurance. The amount of death benefit that the policy will pay is always a substantial factor in determining the value of a life policy.

The face amount almost always equals the death benefit in term insurance. However as time goes by they can begin to diverge. The face value is the death benefit or the amount beneficiaries receive if the insured person dies while a policy is in force.

The face value never changes. In the case of a typical level term life insurance the Face Amount is the amount of insurance for the guaranteed length of time. In the case of whole life insurance the Face amount is the initial death benefit that can fluctuate for numerous contractual.

Depending on the type of insurance policy the death benefit may decrease over time such as with credit life insurance purchased to cover a home mortgage that decreases as the mortgage is paid off. The face amount can range from thousands to millions. The term face value in life insurance refers to the death benefit that is paid to beneficiaries upon the death of the insured.

The face value of a life insurance policy is the amount of death benefit you purchase when you take out the policy and its a primary factor in determining the amount of premium you pay. Life Insurance Policy Valuation Factors. At the beginning of the policy the face value and the death benefit are the same.

The face value of a whole life insurance policy is also known as the death benefit of the policy. It will also be helpful to have the annual statements showing the cash value of. Face value is the death benefit of the life insurance policy.

Face value can also be used synonymously with face amount or coverage amount. Cash value and face value are two elements that make up a permanent life policy. The face value is stated in the policy documents and it often but not always stays the same as the death benefit throughout the life of the policy.

If the premiums have not been paid at some time and the life insurance company has lapsed the insurance company can use the cash value to buy term life insurance for the same coverage level until the cash value runs out. To determine the face value of your policy review it. Some of the factors that go into determining the value of your life policy include.

The face value of a life insurance policy is the death benefit. Most of the US. Therefore if you were to.

The face value of your life insurance policy is your death benefit -- the amount of money that you will leave your beneficiary should you die. That amount is often the amount you choose when you apply for and purchase life insurance coverage. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies.

Whole life and universal life policies are considered permanent life insurance because they will provide coverage for the lifetime of the insured. The face value of a life insurance policy is the death benefit while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. They both reflect the amount of money that the insurance company will pay out in the case of a valid claim.

The face amount in life insurance means the amount of insurance you buy. However the cash value along with the face value can increase.

How Does Whole Life Insurance Work Costs Types Faqs

What Does It Mean For A Life Insurance Policy To Mature Life Ant

Term Vs Whole Life Insurance Policygenius

Whole Life Insurance How It Works

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Life Insurance Guide To Policies And Companies

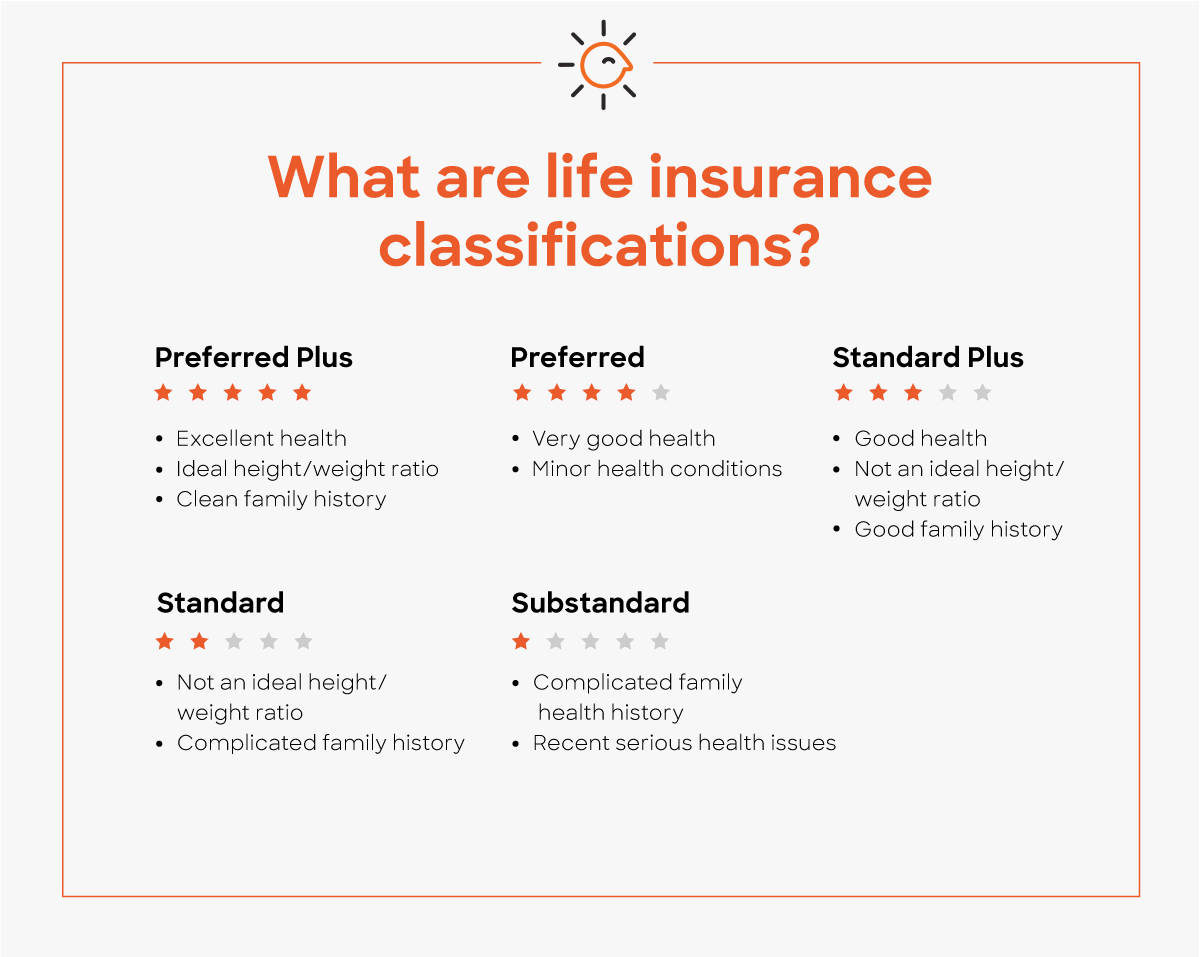

Understanding The Life Insurance Medical Exam Policygenius

Types Of Life Insurance Policies Forbes Advisor

Whole Life Insurance How It Works

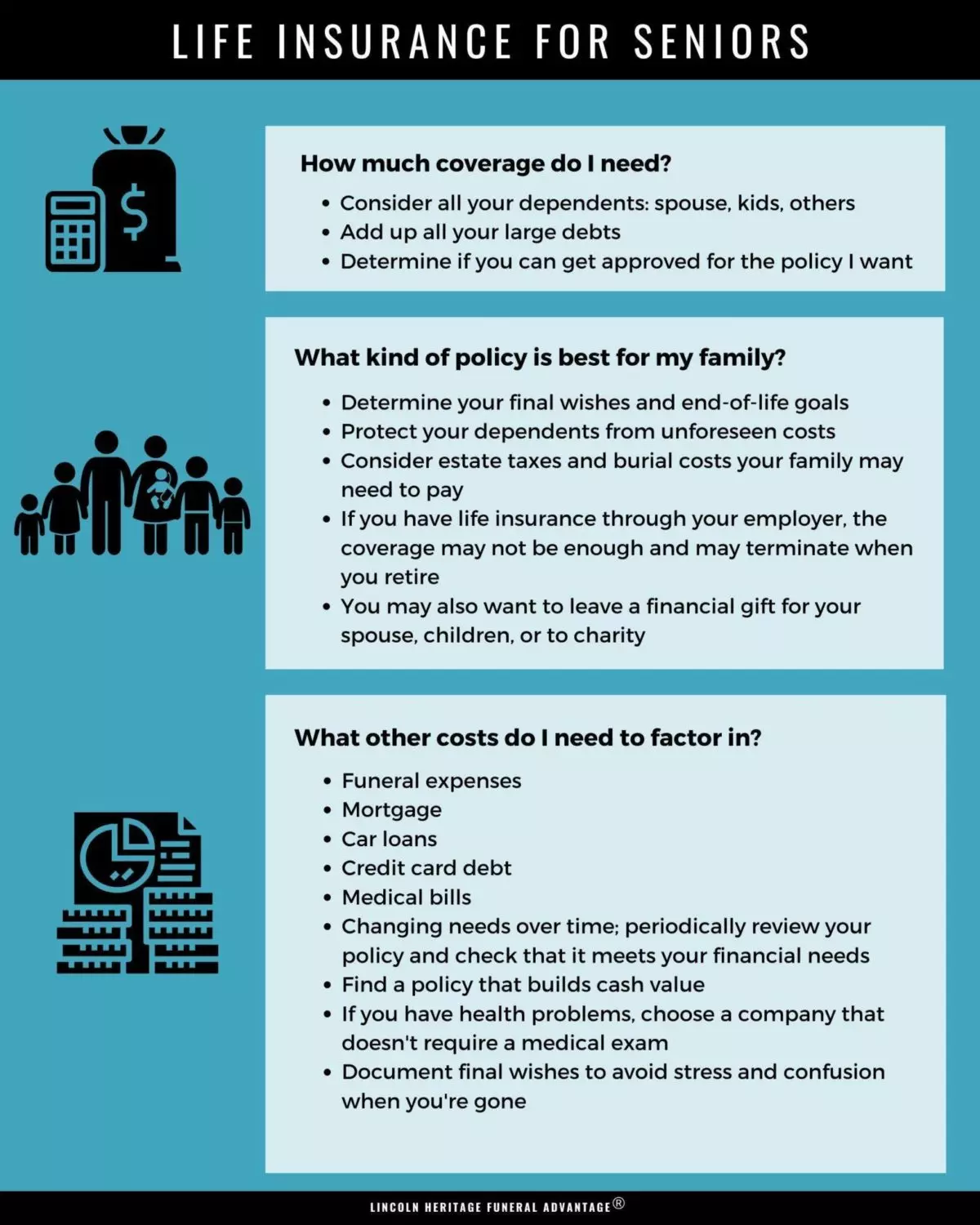

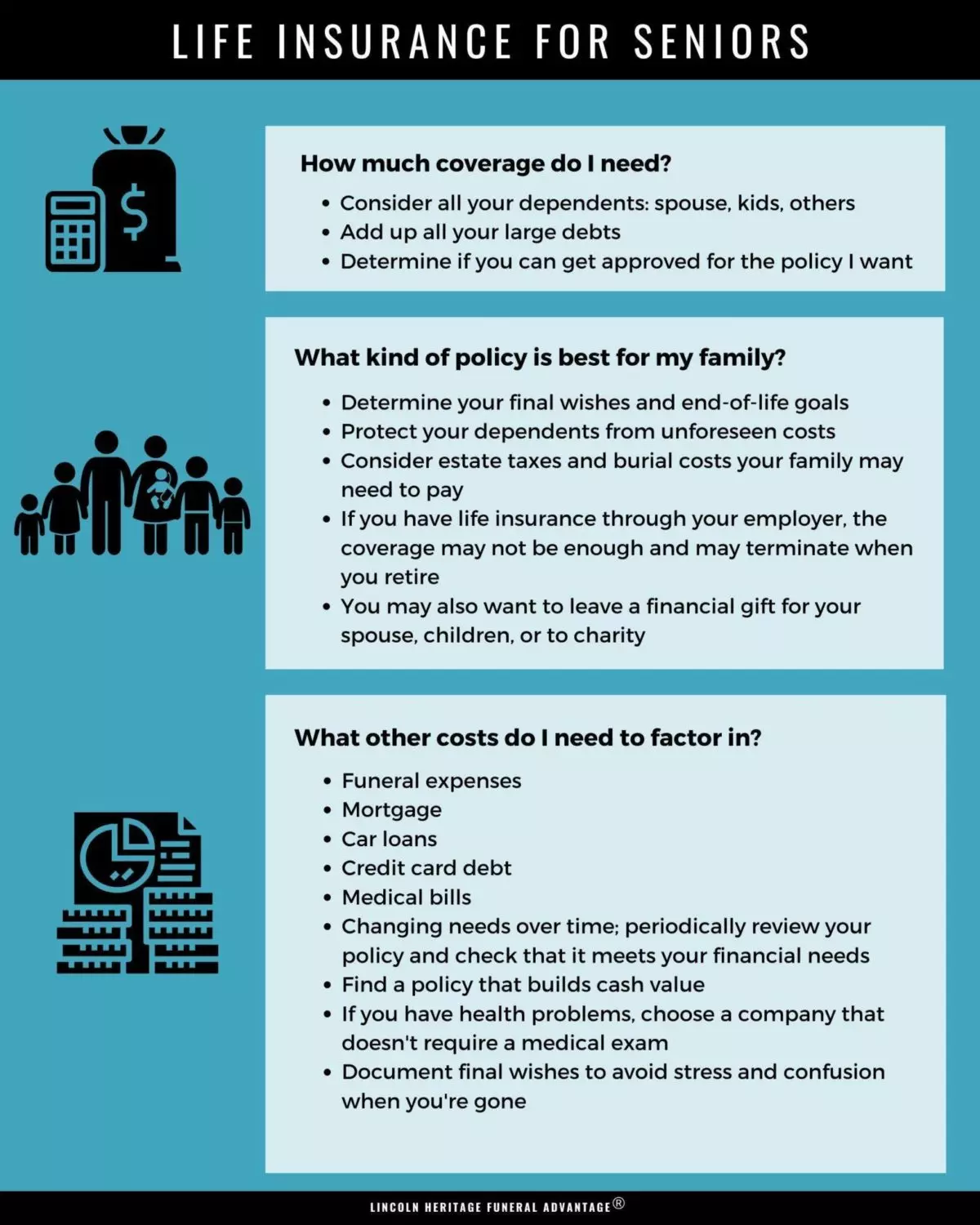

Best Life Insurance For Seniors

2021 Final Expense Life Insurance Guide Costs For Seniors

Difference Between Cash Value And Face Value In Life Insurance

Cash Value And Cash Surrender Value Explained Life Insurance

Glossary Of Life Insurance Terms Smartasset Com

Life Insurance Over 70 How To Find The Right Coverage

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Post a Comment for "What Is Face Value Mean On A Life Insurance Policy"