Does Paying Car Insurance Monthly Build Credit

But paying your insurance on time does help you avoid late fees and get into a good routine that will send you on your way to building credit. If you are late or miss a payment this will bring down your credit rating.

Car Insurance Premium Calculator Moneysupermarket

Paying your annual car insurance payment up front can also earn you other.

Does paying car insurance monthly build credit. While your actual car insurance payments do not affect your credit score either way the same is not true of the insurance company checking your credit score. However paying your insurance on time does help you avoid late fees and get into good habits that could later translate to helping you build credit. Simply paying for car insurance cannot help you build credit.

When you owe money to a car insurance company and it is not paid you can hurt your credit rating. If you pay in full and on time every month this can build up your credit score over time. More often than not insurance companies do not report payment information to credit bureaus so on-time car insurance payments have little to no effect on building your credit score.

Paying your insurance and other bills by credit card requires discipline in order to make it work effectively. You are correct that in the majority of states credit has an impact on your overall rate. In addition you do not have to worry about paying a monthly bill or your car insurance lapsing due to forgetting to make a payment.

You should never leave a balance on a credit card that you cannot afford to pay. Building a history of timely payments is one of the best ways to improve your credit score. These payments will help to establish a credit rating and improve your credit score.

When you pay your car insurance in full you save quite a bit of money over paying monthly. If Im late paying my car insurance will. The short answer is no.

Jul 18 2016. 1 Does paying your car insurance build credit. Car insurance does not help you build credit or improve your credit rating since the premium payments are not considered by the credit reporting agencies to be debt.

Unfortunately making auto insurance payments or any insurance payments is not a method you can use to build your credit score. A car insurance policy paid monthly is a kind of instalment loan and these monthly payments show up on your credit report. Credit bureaus look at any new accounts loans and other aspects where you may have a payment history.

You can still use car insurance to help you build credit by charging it to your credit card and paying it off in full every month says personal finance coach Whitney Hansen. Your auto insurance policy is not directly tied to your credit the same way as. You can get a credit-score boost from your car insurance if you charge it to your credit card and pay it off monthly.

If youre wondering why your credit score seems low check your credit report for. Some car insurance companies will charge a fee if you use a card for monthly payments but will waive any fees if you use your credit card to pay your annual premium in full. Building a credit score is important especially to younger adults.

The Drawbacks of Paying For Car Insurance By Credit Card. Companies in several industries including car insurance providers have access to credit ratings but do not provide information to the system. The answer is no.

But paying your auto insurance on time each month may not be enough to boost your credit score. Paying insurance premiums does not build your credit history. Paying car insurance in full can also be beneficial if you have poor credit as your credit score often comes into play.

If your approach is not disciplined credit card bills can spiral out of control. There are things you can do such as charging your insurance to your credit card and paying it off monthly that will help. There is no direct affect between car insurance and your credit paying your insurance bill late or not at all could lead to debt collection reports.

Does Paying Insurance Build Credit. There are some downsides to using a credit card to pay for your car insurance. Your insurer could also cancel your policy.

There is one way you can use car insurance to build credit if youre clever. But there is one clever hack you can use car insurance to build credit. Whether it is your car insurance or life insurance paying their premiums on time wont count in your credit score.

Therefore carriers do not report positive or negative information to the bureaus because there is no risk of loss. Credits impact on car insurance. Debt collection reports do appear on your credit report often for 7-10 years and can be read by future lenders.

Insurance companies bill in advance of providing the coverage. The nationwide average cost of car insurance is 1691 per year. However you can still use your insurance premiums to build good credit.

This number can be affected based on your credit score among other factors that the insurance company looks at. Paying your credit card bill late can potentially hurt your credit rating. Your car insurance payment can help you build credit by charging it to your credit card and paying it off in full every month.

However maintaining car insurance and paying your bill on time will not result in a significant impact on your credit score like making timely credit card payments. If you would like to build credit using car insurance you can pay it using a credit card and then pay that credit card bill each month. However if you choose to pay your monthly car insurance premiums using your credit card and you make your payments on time it may improve your credit score.

Ask Me How You Can Obtain A Credit Score Of 850 Make This Year Your Year Of Good Credit You Don T Have To Good Credit Bad Credit Improve Your Credit Score

Tips For Car Insurance Autoinsurance Life Insurance Humor Life Insurance Agent Car Insurance

Why Choose Car Insurance Insurance Quotes Compare Insurance Car Insurance

Everything You Need To Know About Sinking Funds Financialli Focused In 2021 Sinking Funds Emergency Fund Saving Save Money Shopping

Car Insurance Premium Calculator Moneysupermarket

As It Is Mandatory To Have Car Insurance In The Uae Dont Miss Out The Chance To Get Your Car Covered In Affordable Pric In 2020 Driver Covers Car Insurance Car Covers

Customizing Monthly Car Insurance No Deposit For Optimum Benefits Car Insurance Insurance Car

Monthly Budget Planner Printable Monthly Budget Printable Pdf Monthly Budget Template Printable Budget Worksheet Budget Planner Bundle Maandelijkse Budgetplanner Budget Werkbladen Budget Planner

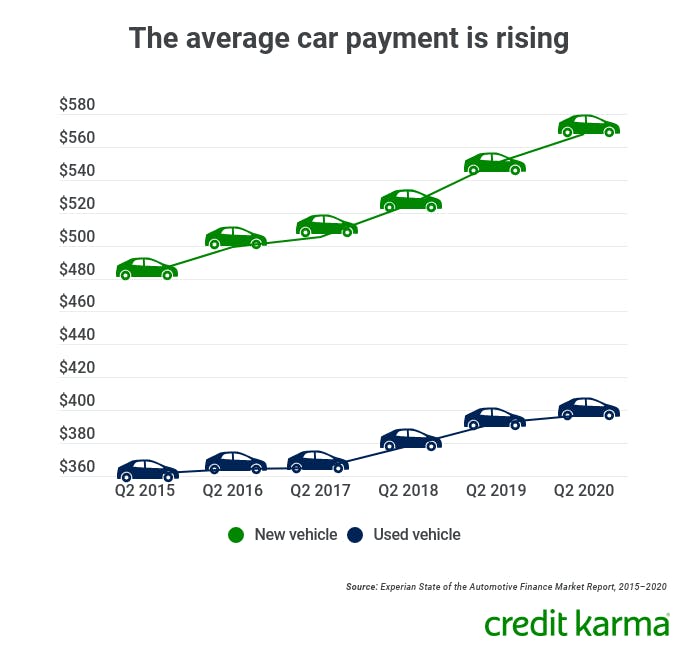

What Is The Average Car Payment Credit Karma

Becoming Her On Instagram Cash Is King And Credit Is Power You Could Be Leaving So Much On The Table Finan Good Credit Credit Repair Services Repair Quote

Facing High Payment Issues With Auto Insurance Let Us Help You Freecarinsurancequote Help You Find Low Deposit Car Insurance Insurance Getting Car Insurance

Cheap No Deposit Monthly Car Insurance Life Insurance Quotes Home Insurance Quotes Insurance Quotes

Cheap Car Insurance How To Get Affordable Auto Insurance Rates Cheap Car Insurance Car Insurance Insurance

Why Is Car Insurance So Expensive Moneysupermarket

Car Insurance Premium Calculator Moneysupermarket

Annual Vs Monthly Car Insurance Moneysupermarket

I Ve Been Budgeting Lately And Wanted A Personalized Budget Form With All The Little Details That I Was Lo Budget Planning Budgeting Money Budgeting Worksheets

Myth Vs Fact Carrying Balances On Credit Cards Credit Repair Build Credit Credit Repair Services

Most Up To Date Screen How Insurance Quotes Uk Compare Can Increase Your Profit Insurance Quotes Uk Comparison Quotes Auto Insurance Quotes Insurance Quotes

Post a Comment for "Does Paying Car Insurance Monthly Build Credit"