What Does Extended Term Insurance Mean

What is Extended Term Insurance. The new policy would be purchased with the cash value you had built in your old life insurance plan.

Homeowners Insurance Cover Compare Home Insurance Options And Deals Homeowners Insurance Coverage Home Insurance Quotes Home Insurance

Extended term insurance is the default non-forfeiture options.

What does extended term insurance mean. With the extended term insurance the face amount of the policy stays the same but it is flipped to an extended term insurance policy. What does extended term insurance mean. Definition of Extended term insurance Nancy Danyo Cuddihy Real Estate Agent Premiere Realty Group LLC Nonforfeiture option that uses the cash value of an ordinary life policy as a single premium to purchase term life insurance in the amount of the original policy.

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. One of the nonforfeiture options contained in most whole life and endowment policies. Extended term insurance allows a policyholder to quit paying the premiums but not forfeit the equity of their policy.

Read on to discover the definition meaning of the term Extended Term Insurance - to help you better understand the language used in insurance policies. Extended term insurance allows policyholders to stop paying premiums once the cash value of the policy grows to a self-sustaining amount. You have a 100000 whole life policy that has built up some cash value.

The equity you built is used to purchase a term policy that. Extended term insurance is a nonforfeiture option which may be included with insurance to extend the coverage for a limited period of time upon the failure of a policy-holder to pay the premiums. The policy is usually a whole life policy but can originate from other cash value plans.

Typically the ability to exercise this option has to do with the. Here are the basics of extended term life insurance and how it works. The feature primarily seeks to help those who find themselves in a situation where the whole life premium is no longer affordable.

Over the years this amount of money can grow to become very. Extended term insurance is a type of life insurance that is designed to make whole life insurance more attractive. Extended term insurance is life insurance is a life insurance policy where the policy holder stops paying the premiums but still has the full amount of the policy in effect for whatever term the cash value permits.

If the insured dies during the time period specified in the. The equity you built is used to purchase a term policy that equals the number of years you paid premiums. Extended term insurance is a type of life insurance that is designed to make whole life insurance more attractive.

Insuranceopedia Explains Extended Term Insurance. Extended coverage insurance is supplemental coverage added to a standard fire policy as an endorsementIt extends coverage to hail windstorm explosion civil commotion riot vehicles aircraft and smoke perils. Extended term insurance is a nonforfeiture option which may be included with insurance to extend the coverage for a limited period of time upon the failure of a policy-holder to pay the premiums.

The term is limited. Extended term insurance definition life insurance in which a policyholder ceases to pay the premiums but keeps the full amount of the policy in force for whatever term the cash value permits. Extended term life insurance is coverage that is provided by the cash value in a life insurance policy.

The amount of cash value you will have built in your policy will be reduced by the amount of any loans against it. Policyholders can then choose to extend coverage after a term ends by either 1 purchasing a new policy or 2 converting a qualified term insurance policy to a permanent life insurance policy. If the investment portion of the insurance policy is sufficient to cover payments for it the holder of an extended term insurance can simply modify their whole life insurance policy into a.

Definition Extended Term Insurance a nonforfeiture provision in a whole life policy that uses cash value to purchase term insurance equal to the existing amount of life insurance. If premiums are not paid any dividend additions or accumulations minus any indebtedness will be used as a single premium payment for that term. Here is an example.

Extended term insurance is often the default non-forfeiture option. Extended term insurance is a provision that is sometimes included in the terms of conditions of an insurance policy. Instead of canceling their policy and losing their death.

When you purchase a whole life insurance policy part of the premiums that you pay are going to go towards accumulating a cash balance. It provides that the policy owner may elect to have the cash surrender value of the policy. With the inclusion of the provision the insurance coverage can continue to exist for an additional period of time.

Herein what does extended term insurance mean. What does Extended Term Insurance mean. Here are the basics of extended term life insurance and how it works.

However nowadays standard property policies often include these perils in. The term is limited to the period that the available. Extended term insurance is a nonforfeiture option on a whole life policy that uses the policys cash value to buy term insurance for the current whole life death benefit for a specified period of time.

Not The Same as Extended Coverage This is not to be confused with extended coverage a term used in the property insurance business.

How Does Whole Life Insurance Work Costs Types Faqs

Making Sense Of Iot Internet Of Things The Iot Business Guide

When Your Weather App Gives You Inspirational Quotes To Keep On Living Term Life Best Insurance How To Protect Yourself

Life Insurance For Seniors Over 70 Life Insurance For Seniors Life Insurance Policy Affordable Life Insurance

Short Term Vs Long Term Disability Insurance Disabilityinsurance Insurance Disability Term Life Insurance Quotes Life Insurance Quotes Disability Insurance

Group Term Insurance Plan Sampoorn Suraksha Sbi Life

The Best Life Insurance Companies Of July 2021 Life Insurance Quotes Life Insurance Policy Life Insurance Companies

Expat Health Insurance In The Netherlands Zorgwijzer

The Difference Between Short Long Term Disability Insurance

Term Life Insurance Policygenius

How To Get Health Insurance On The New York State Exchange What To Consider Where To Look How To Do It Done Family Income How To Get Health Insurance

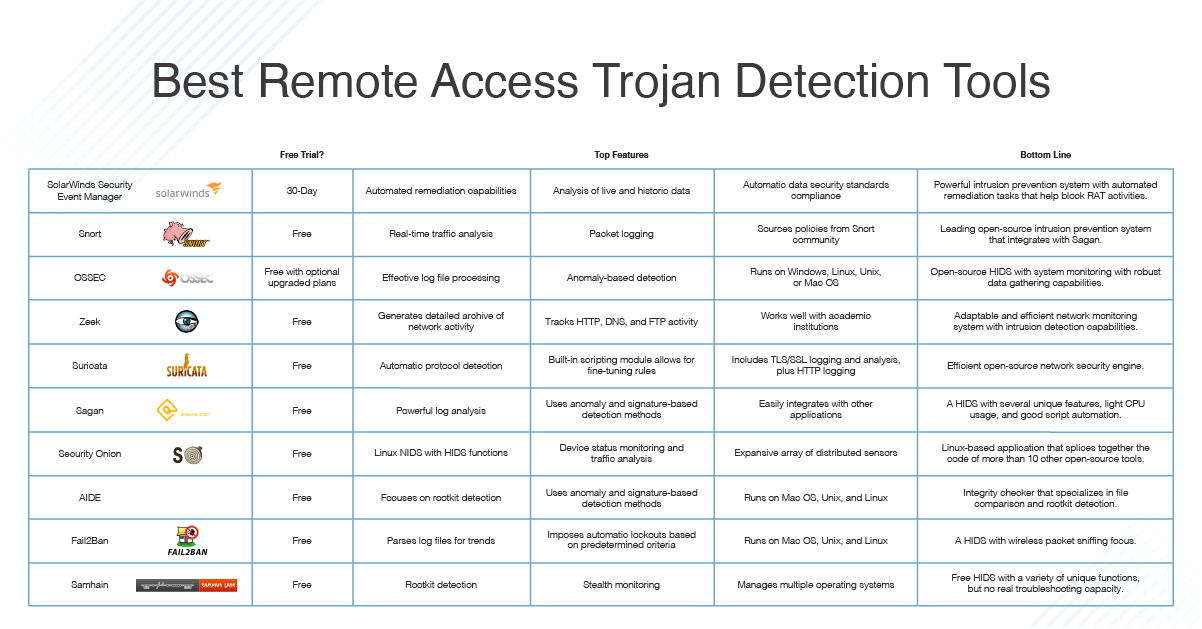

Remote Access Trojan Detection Software Rat Protection Guide Dnsstuff

/shutterstock_112522391-5bfc2b9846e0fb0051bde2d3.jpg)

Paid Up Additional Insurance Definition

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Term Insurance Best Term Plans Policy Online In India 2021

Term Life Insurance Explained Forbes Advisor

Incoterms 2020 Explained The Complete Guide Incodocs

Uha Factors That Impact Health Insurance Premiums Health Insurance Insurance Premium Health

2020 Perspectives On The Business Impact Of Covid 19 Mckinsey

Post a Comment for "What Does Extended Term Insurance Mean"