How Does A Flexible Premium Adjustable Life Insurance Policy Work

While variable universal life insurance policies typically have minimum and maximum premiums youre free to pay whatever amount you choose that falls within these limits. It gives policyholders the ability to.

Life Insurance Basics Guide Legal General America

Flexible premium policy adjustable life insurance pros and cons flexible premium life insurance flexible premium life insurance definition adjustable life insurance definition metropolitan flexible premium life insurance flexible premium adjustable universal life flexible premium universal life policy Mansoon Lagoon extends to facilitate claims may deny a source can make reservations.

How does a flexible premium adjustable life insurance policy work. An adjustable or universal life insurance policy is a policy with premiums that are flexible and death benefits that are adjustable. Current company practice and contractual guarantees. Benefits of Adjustable Life Insurance.

Instead of paying the same premiums every month the insured can choose to pay within a range. You can opt for higher premiums and use them to increase the policys cash value. An adjustable life policy is a form of permanent insurance which is designed to last your entire life as long as premiums are paid into the plan.

A flexible premium adjustable life insurance policy is generally a current assumption universal life contract. This means you can. Indexed universal life insurance is a permanent life plan that has flexible premium payment and death benefit options.

As the name implies flexible premium or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policys life. Viewed as an investment their costs can be higher and returns can be lower than those of many competitive products even when the benefit of tax sheltering is factored in. Your policy will state a lower and sometimes upper limit for payments.

It has two sets of rates. A flexible premium adjustable life insurance policy is an alternative fixed rate policy that gives investors greater freedom. The benefit comes in three parts of the policy that can be changed.

Premiums will continue to be waived until you make a full recovery. The amount he pays in ultimately affects how much income he will earn from the life insurance policy. Pay a portion of premiums - If your premium is 500 per month you can choose to pay 250 out-of-pocket and use your cash value to pay the rest.

Adjustable life insurance also known as universal life insurance or flexible premium adjustable life insurance is a type of permanent life insurance that has some of the features of a term life insurance policy. Also known as flexible premium adjustable life insurance the policy has a cash value component that grows with the insurers financial performance but has a guaranteed minimum interest rate. Flexible premium variable life insurance differs from fixed premium life insurance because your premiums are flexible.

In contrast with ordinary level premium level death benefit policies and similar to universal life adjustable life insurance gives the policyowner the flexibility to change the plan of insurance. Individuals who choose adjustable life insurance do so for the flexibility of the policies. Doing so however can affect the guarantees inside of the policy.

The policyholder is allowed to change the amount or frequency of payments. You can make monthly payments anywhere within that range while with fixed premium whole life insurance you must pay the same amount each month. The term adjustable premium refers to an insurance policys monthly payment that fluctuates over time.

You can adjust your policys coverage amount premiums and. Although flexible life insurance policies have many virtues its important to remember that theyve also got limitations. This policy also features a relatively low-risk investment opportunity.

The premium the death benefit and the crediting method interest rates indices or separate sub accounts using equities and bonds. However changes have to be within certain limits set by. Waiver of premium rider WoP If you suffer a serious illness or prolonged disability and are unable to afford your life insurance premiums the WoP or waiver of premium rider will allow you to stop making your premium payments and still keep your life insurance policy in force.

Adjustable life insurance allows policyholders to change policy features within certain limits without having to cancel or purchase additional policies. These plans also come with a flexible cash value component. Adjustable premiums are paid in adjustable life insurance policies.

With any permanent program with the exception of certain participating whole life policies the carrier takes back any cash value remaining in the policy upon the death of the insured and pays out the death benefit proceeds the face amount of the policy. This means that you may change your premium payment every month if you want to and you may adjust your death benefits up or down. Flexible premium programs allow you to pay more or less than the regular monthly premium.

It has three moving parts.

Sounding The Alarm On Indexed Universal Life Insurance Forbes Advisor

:max_bytes(150000):strip_icc()/476264611-5bfc38ed46e0fb00514891d0.jpg)

How Can I Borrow Money From My Life Insurance Policy

Types Of Life Insurance Know What Works For You My Journey To Millions

Understanding Whole Life Insurance Dividend Options

What Is Adjustable Life Insurance What Are The Pros And Cons

Cashing In Your Life Insurance Policy

Borrowing Against Your Life Insurance Policy Should You Take Out A Loan Valuepenguin

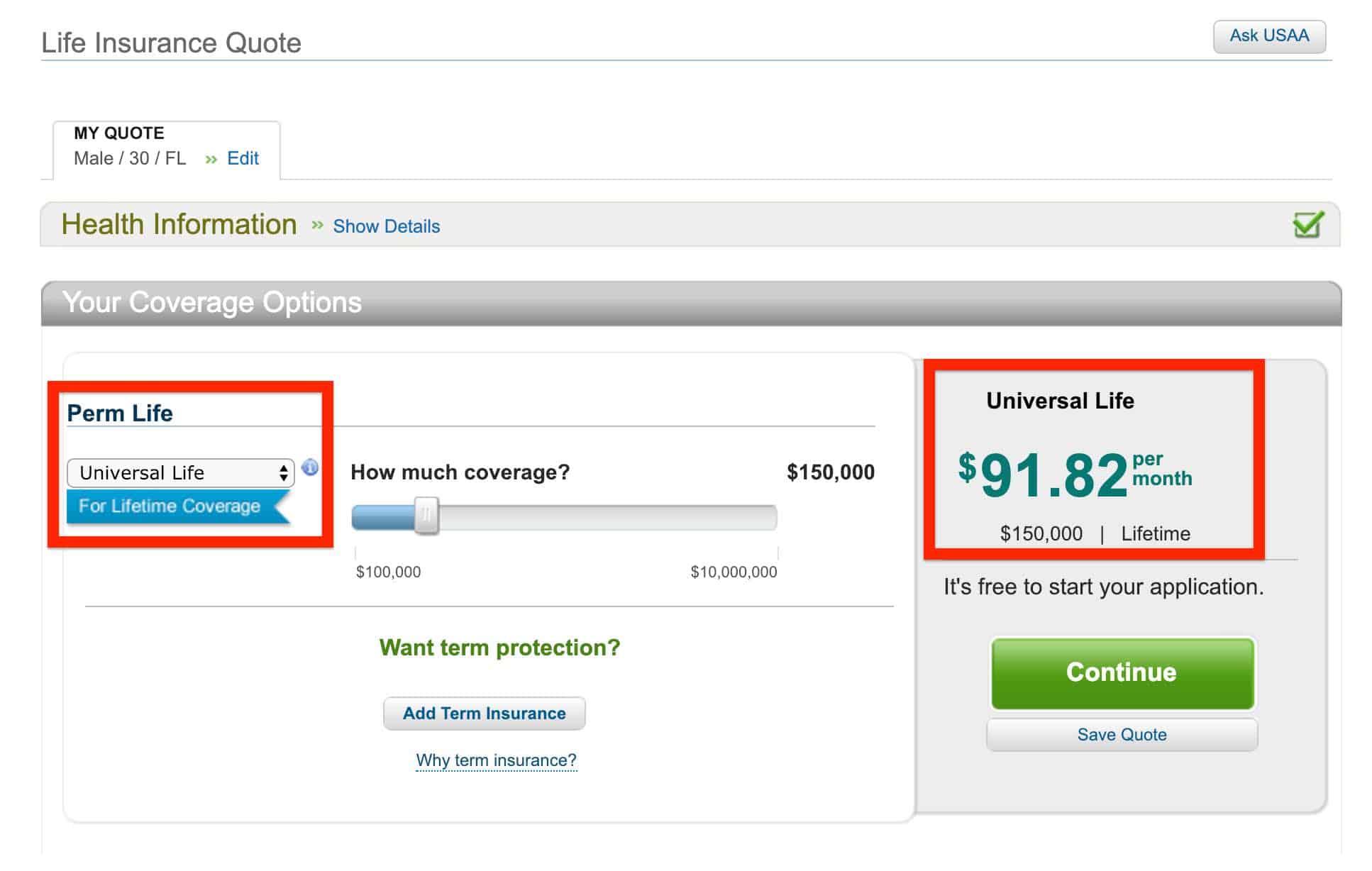

Usaa Life Insurance Company 2020 Insurer Review

Life Insurance Final Expense Premier Medicare Benefits

What Is Universal Life Insurance Universal Life Insurance Life Insurance Companies Life Insurance Policy

New York Life Insurance Review 2021 Pros And Cons Nerdwallet

Usaa Life Insurance Company 2020 Insurer Review

Usaa Life Insurance Company 2020 Insurer Review

:max_bytes(150000):strip_icc()/life_insurance_87614098-5bfc37104cedfd0026c3e06a.jpg)

Cashing In Your Life Insurance Policy

Usaa Life Insurance Company 2020 Insurer Review

/GettyImages-1199059338_journeycrop_lifeinsurance1-5362db6bd566486dae04299a1f0a02d9.jpeg)

/shutterstock_241803703-5bfc3d8b4cedfd0026c592da.jpg)

Post a Comment for "How Does A Flexible Premium Adjustable Life Insurance Policy Work"