Face Value Life Insurance Statistics

In 2018 the United States was the leading life insurance premium writing country with a total value of life direct premiums written amounting to 5934 billion US. Meanwhile the average face value has steadily increased from 110000 to over 170000 indicating that life insur - ers are failing to reach the middle market.

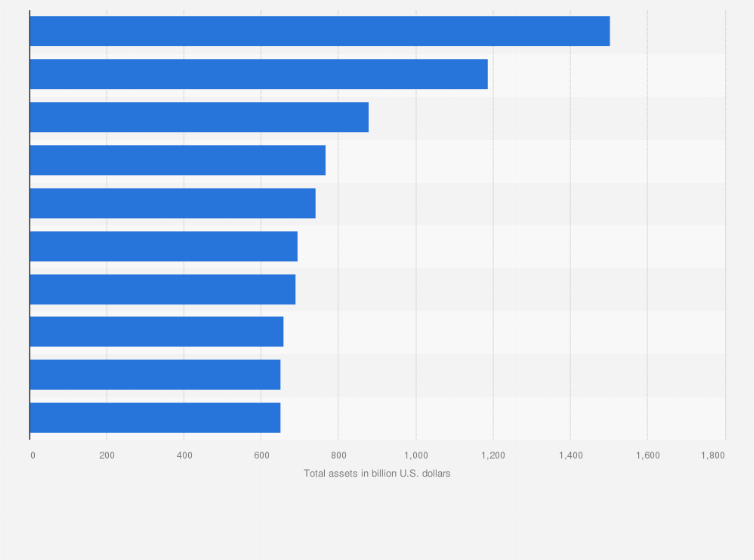

Leading U S Life Insurers By Market Cap 2021 Statista

The second and third.

Face value life insurance statistics. The average face amount of life insurance policies in the United States in 2019 was 178150. In 2018 the aggregate face amount of life insurance. This statistic presents the total face amount of life insurance policies in force in the United States from 2009 to 2018.

In 2018 the average face amount of individual life insurance policies purchased in the United States was about 168 thousand US. For example a person who. The overall amount has increased somewhat from 172040 in 2009.

Because life insurance products are long-term generally in force for 10 years or longer payments are predictable. In participating whole life insurance the paid-up insurance owned by the policy holder continues to earn dividends which increases the face value of the policy regardless if you have a policy loan outstanding or not. How Face Value Influences Cost Face value is one of the most important factors that contribute to the cost of a life insurance policy.

Are you interested in testing our corporate solutions. Skip to main content. Insurance industry net premiums written totaled 128 trillion in 2020 with premiums recorded by propertycasualty PC insurers accounting for 51 percent and premiums by lifeannuity insurers accounting for 49 percent according to SP Global Market Intelligence.

Skip to main content. We put together the following life insurance statistics and facts to help our readers get a better grasp of just how big the life insurance marketplace is and to get a better understanding of why choosing a highly rated life insurance company is important when deciding on what carrier to buy life insurance with. The amount of death benefit that the policy will pay is always a substantial factor in determining the value of a life policy.

PC insurer cash and invested assets were 19 trillion in 2019. Shared-value life insurance products such as Vitality are in the vanguard. For example a policy with a face amount of 1 million will be much more valuable than one with a face amount of 100000.

Statistics about Face Amounts. This statistic shows the face amount of life insurance in force in the United States in 2009 by state. Are you interested in testing our corporate solutions.

ACLI The average face value of policies does fluctuate year-on-year but theres a slow and steady growth trend. In 2017 that number grew to about 163000. According to McKinsey mass affluent re - search in 2015 only 65 percent of Ameri-cans who are married with dependents have a life or an annuity policy while 97.

According to Statista the average Face Amount of Life insurance purchased in the United States in 2015 was about 160000. Please do not hesitate to contact me. Some of the factors that go into determining the value of your life policy include.

Currently there are over 280 million life insurance policies in force across the US. Try our corporate solution for free. Try our corporate solution for free.

Average life insurance face amounts have come down from a high point of 175000. 66 of Americans or 2 in 3 individuals buy life insurance to transfer wealth to other generations. Therefore lifeannuity insurers invest primarily in long-term products.

Please do not hesitate to contact me. 54 Percent of American adults who have life insurance 27 Of American adults with life insurance the percent who only have group coverage which usually isnt enough and is. Life Insurance Policy Valuation Factors.

The average face value of an individual life insurance policy is 160000. Besides the fact is that universal life insurance policies NEVER earn dividends and that means the only thing gained by borrowing from a universal life insurance policy it the. Hadley Ward Mon - Fri 9am - 6pm EST 212 419-8286 hadleyward.

Now in 22 markets the program has seen a 35 percent reduction in mortality among highly engaged members and a 15. Top Life Insurance Statistics In 2020 54 of Americans are insured down from 57 in 2019 with 1 in 3 families remaining uninsured. Life insurance and annuity cash and invested assets totaled 43 trillion in 2019 and separate accounts assets and other investments totaled 28 trillion.

44 of Millennials overestimate the cost of. Developed by Discovery Group in South Africa Vitality pioneered the model of shared-value economics in its product design and pricing leading to the creation of an engaged wellness ecosystem.

How Does Life Insurance Work Forbes Advisor

Insurance Market Outlook For 2018 2019 Munich Re Topics Online

Leading Premium Writing Countries Globally By Premiums 2019 Statista

Life Insurance The Cold Hard Numbers Nasdaq

Largest Global Insurers By Assets 2020 Statista

Insurance Market Outlook For 2018 2019 Munich Re Topics Online

Insurance Market Outlook For 2018 2019 Munich Re Topics Online

Insurance Density In Emerging Markets 2019 Statista

Top 10 Insurance Companies In Vietnam 2019 Life Insurance Companies Insurance Company Life Insurance Agent

What Is Term Life Insurance And How Does It Work Money

3 Ways To Generate Life Insurance Leads Life Insurance Sales Life Insurance Facts Life Insurance Marketing

Largest Global Insurers By Assets 2020 Statista

Term Vs Whole Life Insurance Policygenius

Insurance Market Outlook For 2018 2019 Munich Re Topics Online

Protecting My Family Life Insurance Quotes Life Insurance Facts Life Insurance Sales

Insurance Market Outlook For 2018 2019 Munich Re Topics Online

Life Insurers Where To Play For Value In Asia Pacific Mckinsey Company

Post a Comment for "Face Value Life Insurance Statistics"