Extended Term Insurance Formula

What is Extended Term Insurance. Its not another form of insurance but an option for the.

Pdf South Africa Leading African Insurance

Some insurance companies have extended term as the default non-forfeiture option for cash value plan whole life plans when you miss a premium others have automatic premium loan.

Extended term insurance formula. The insurance company would take the cash balance that is remaining on the policy and then use that amount of money to purchase term insurance. The present value of the insurance companys payment under the contract is evidently FT x vTmx1m if x T xn 0 otherwise 42 The simplest and most common case of this contract and formula arise when the face-amount F0 is the constant amount paid whenever a death within the term occurs. Your age at the time you trigger the extended term insurance feature.

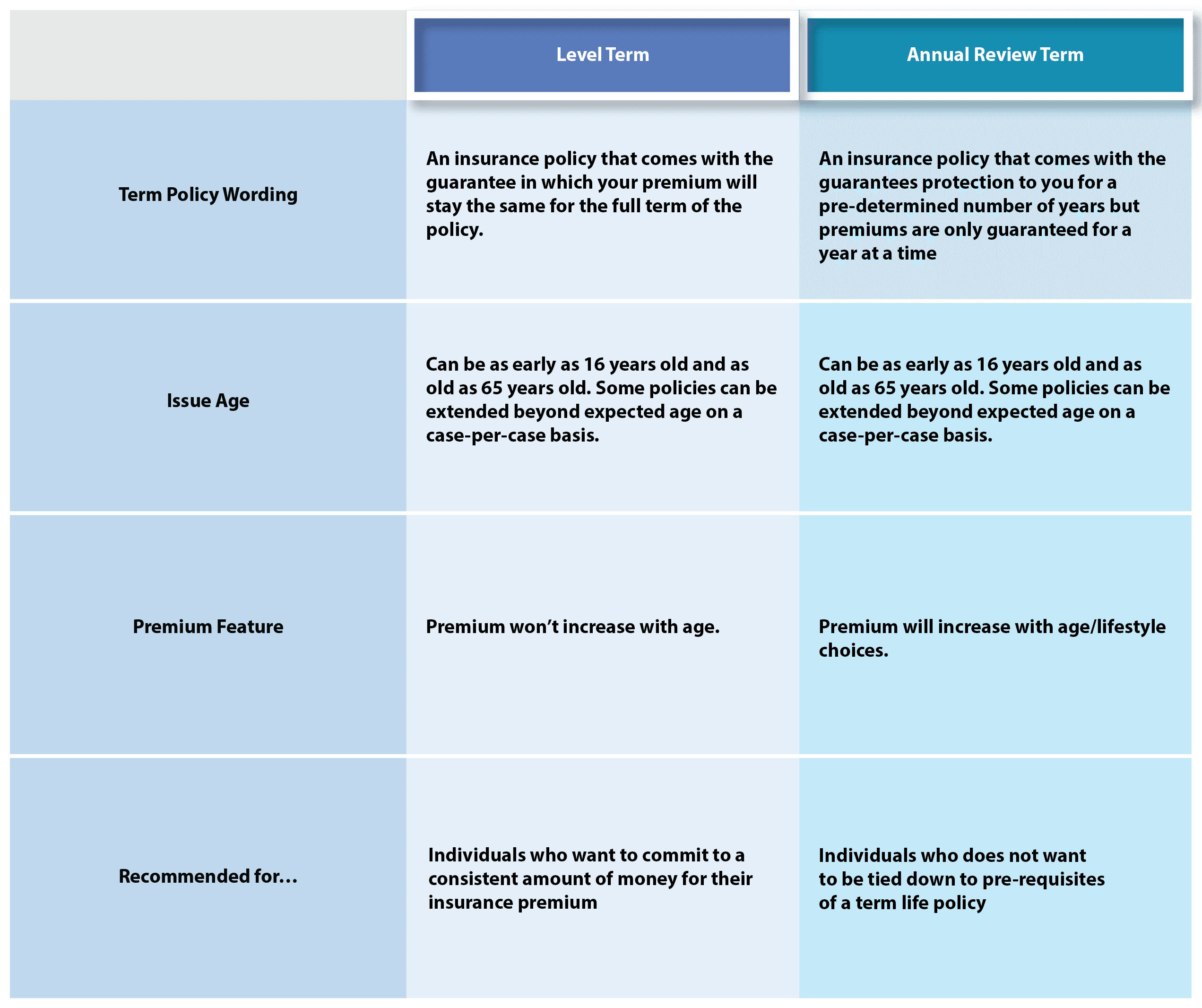

Technically speaking this is your only option to actually extend your term life insurance policy. TERM INSURANCE CALCULATION ILLUSTRATED a a a a a a a a a a a a a a a a a a a -. This is referred to as extended term.

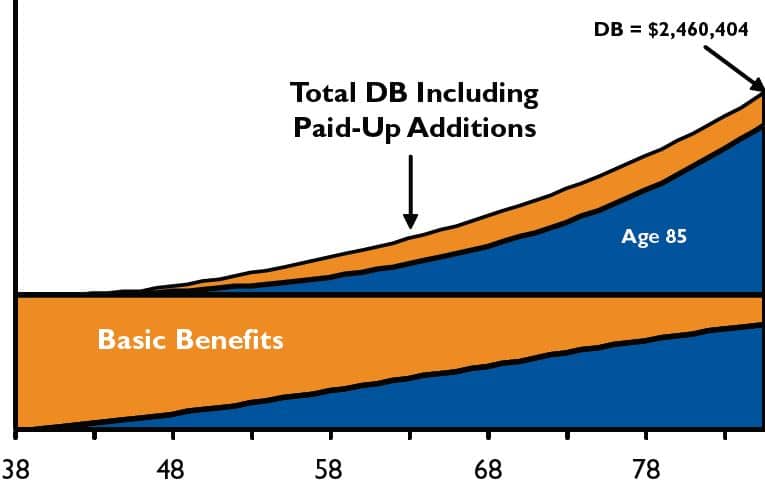

If the investment portion of the insurance policy is sufficient to cover payments for it the holder of an extended term insurance can simply modify their whole life insurance policy into a term life policy paid for through the whole life policys cash. The equity built up is used to purchase a term policy that equals the number of years you paid premiums. Life insurance in which a policyholder ceases to pay the premiums but keeps the full.

The equity you built is used to purchase a term policy that equals the number of years you paid premiums. The cash value is used to provide you with 100000 of coverage for a specified term based on the cash value. When a person does not want to continue making payments on a whole life insurance policy they have options with what they can do with the cash value that has accumulated in the policy.

An extended replacement cost ERC can give you a little extra insurance coverage. Definition of Extended term insurance Nancy Danyo Cuddihy Real Estate Agent Premiere Realty Group LLC Nonforfeiture option that uses the cash value of an ordinary life policy as a single premium to purchase term life insurance in the amount of the original policy. Extended term is one of the non-forfeiture provisions.

Extended Term Insurance a nonforfeiture provision in a whole life policy that uses cash value to purchase term insurance equal to the existing amount of. B Upon default in payment of a premium within the grace period on any permanent plan of National Service Life Insurance other than the modified life plan and any plan of insurance issued under 38 USC. This is something that has to be in place when you buy the policy though not something that can be just added on because you see your term is running out and would that option.

The face amount of the policy stays the same but its changed to an extended term insurance policy. The extended term insuranceoption differs from the reduced paid-up insurance option as it does not allow the policy to continue to earn interest increase cash value or pay dividends if dividends are applicable. Then the payment is F0 with present value.

When you purchase a whole life insurance policy part of the premiums that you pay are going to go towards accumulating a cash balance. Meaning pronunciation translations and examples. Lets assume that in this example were using your 20000 will buy you 22.

Here are the basics of extended term life insurance and how it works. Extended term insurance definition life insurance in which a policyholder ceases to pay the premiums but keeps the full amount of the policy in force for whatever term the cash value permits. In Insurance Terms Extended Term Insurance Is Defined As.

This type of insurance is defined as a default non-forfeiture option. 1925 if the policy has been in force by payment or. It does however allow the face amount of the policy to remain the same for a specified period of time.

3113 Extended Term Insurance. If a unit is payable at the moment of the death x then b t 1 t n 0 t n v t vtt 0 Z vT T n 0 T n Where the force of. Level Benet Insurance n-year term life insurance A payment only if the insured dies within the n-year term of an insurance commencing at issue.

Extended term insurance allows policyholders to stop paying premiums once the cash value of the policy grows to a self-sustaining amount. Extended term insurance is a type of life insurance that is designed to make whole life insurance more attractive. Purchasing extended replacement cost would allow.

The amount of cash value in your policy at the time you trigger the feature. Extended term insurance is the default non-forfeiture options. The individual would then be covered by a term life insurance policy that lasted for a specific period of.

Extended term insurance definition. Whenever an individual could not afford to continue paying their premiums they would instead be able to get extended term insurance. The extended term insurance shall not have a loan value but shall have a cash value.

With the extended term insurance the face amount of the policy stays the same but it is flipped to an extended term insurance policy. The death benefit of your policy. What is extended replacement cost ERC mean on my.

When insurance companies determine the replacement cost of your home which is used to determine Coverage A they are using the best available information they have at the time.

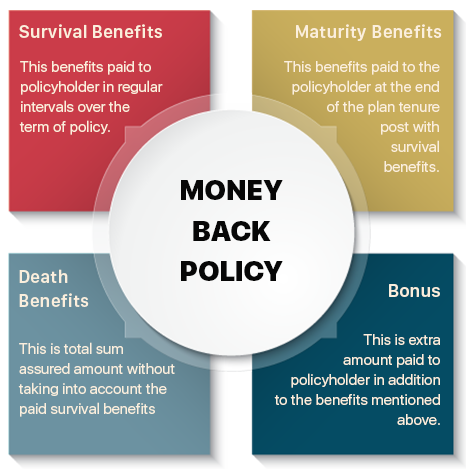

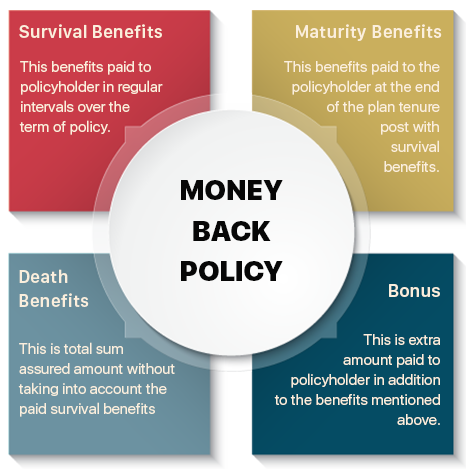

Money Back Policy Compare Money Back Plans Features Reviews

Lic S New Bima Gold 179 Details With Premium And Benefit Calculators Insurance Funda

Pdf Analytical Validation Formulas For Best Estimate Calculation In Traditional Life Insurance

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

What Is The Extended Term Insurance Option The Insurance Pro Blog

Who Needs Life Insurance Insurance Lifeinsurancepolicy Lifeinsurance Single Life Insurance Calculator Life Insurance Types Life Insurance Policy

Understanding Whole Life Insurance Dividend Options

Understanding Your Life Insurance Policy Policygenius

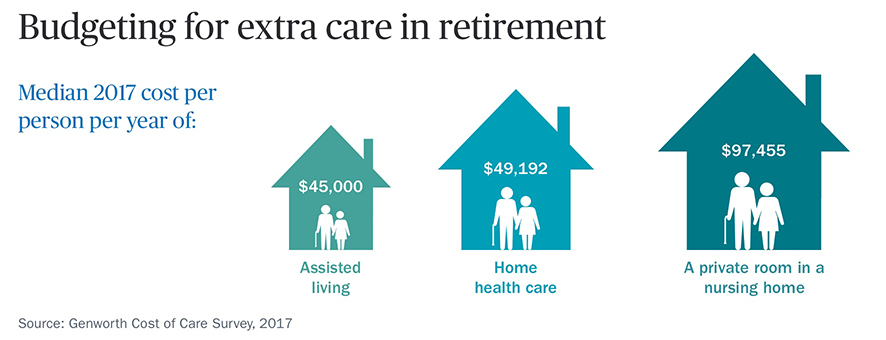

Long Term Care Insurance Cost Ameriprise Financial

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Term Vs Whole Life Insurance Policygenius

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Pdf Asset Liability Management For Long Term Insurance Business

Https Www Ia Org Hk En Supervision Reg Ins Intermediaries Files 11 Sn Lt 2017 Eng Pdf

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Best Term Life Insurance Policies In Malaysia 2021 Compare And Buy Online

Lic Jeevan Anand 149 Features Benefits And Maturity Calculator Insurance Funda

How Does Whole Life Insurance Work Costs Types Faqs

What Is The Extended Term Insurance Option The Insurance Pro Blog

Post a Comment for "Extended Term Insurance Formula"