Determine Face Value Of A Life Insurance Policy

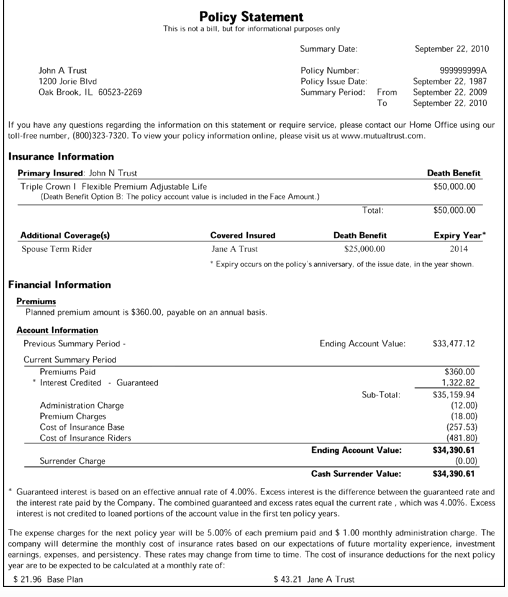

The amount of death benefit that the policy will pay is always a substantial factor in determining the value of a life policy. For example if the face value of your permanent life insurance policy is 100000 and you borrowed 5000 against the loan your insurance provider will subtract the outstanding 5000 loan from the face value meaning that your beneficiaries will receive 95000 instead of the full 100000 face value.

Term Vs Whole Life Insurance Policygenius

The face amount of a life insurance policy depends on the coverage the policyholder requires.

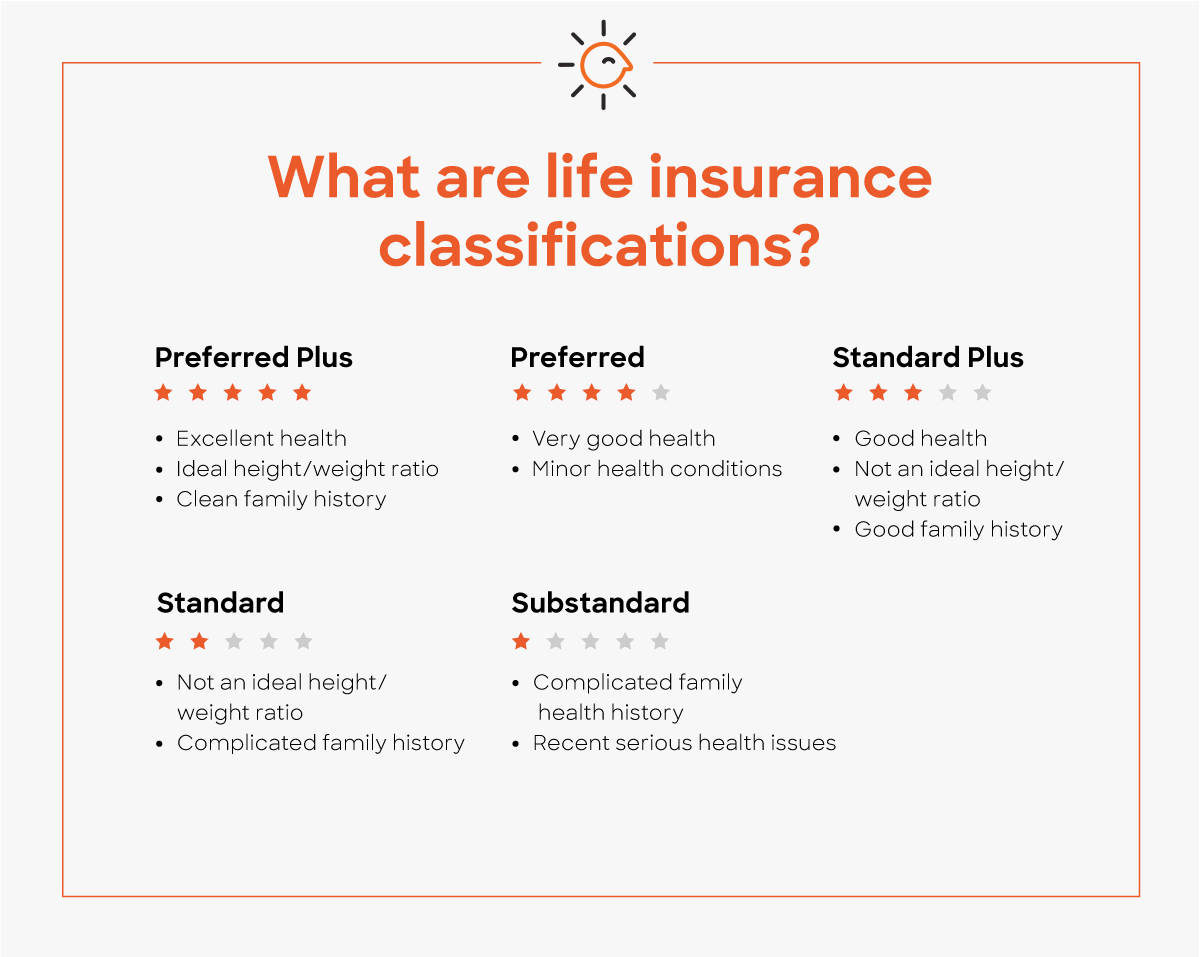

Determine face value of a life insurance policy. The face value of a policy differs from the cash value which is an investment-like component that supplements some whole life insurance policies. Both whole life insurance and universal life insurance carry value. This is the stated dollar amount that the policys beneficiaries receive upon the death of the insured.

This is the amount the insurance company will pay the beneficiaries named on the policy upon the death of the policyholder. Fair Market Value FMV. Whole life insurance policies while counted towards Medicaids asset limit are exempt not counted up to a certain face value.

Face value is the. The cash value of a life insurance policy is meant to be accessed while youre still alive it can be used to pay your policy premiums withdrawn for cash or borrowed against. Ten years later your policys cash value has grown to 750000.

Ultimately the policys market value will determine what someone is willing to pay for your policy. The face value of a life insurance policy is the death benefit while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. The amount of cash value that has accumulated inside a policy is another.

Face value is different from cash value which is the amount you receive when you surrender your policy if you have a permanent type of life insurance. Add up your assets Find the sum of your post-tax income and any liquid assets like life insurance policies you already own current investments and future assets like social security benefits. In most cases the face value is transferred to the beneficiaries tax-free.

The reasons for a change in the death benefit can include additional paid-up insurance bought with dividends and having an increasing death benefit based on the cash value such as with a universal life insurance policy. 4 Ways of Determining Life Insurance Policy Value 1. Furthermore any unpaid interest will.

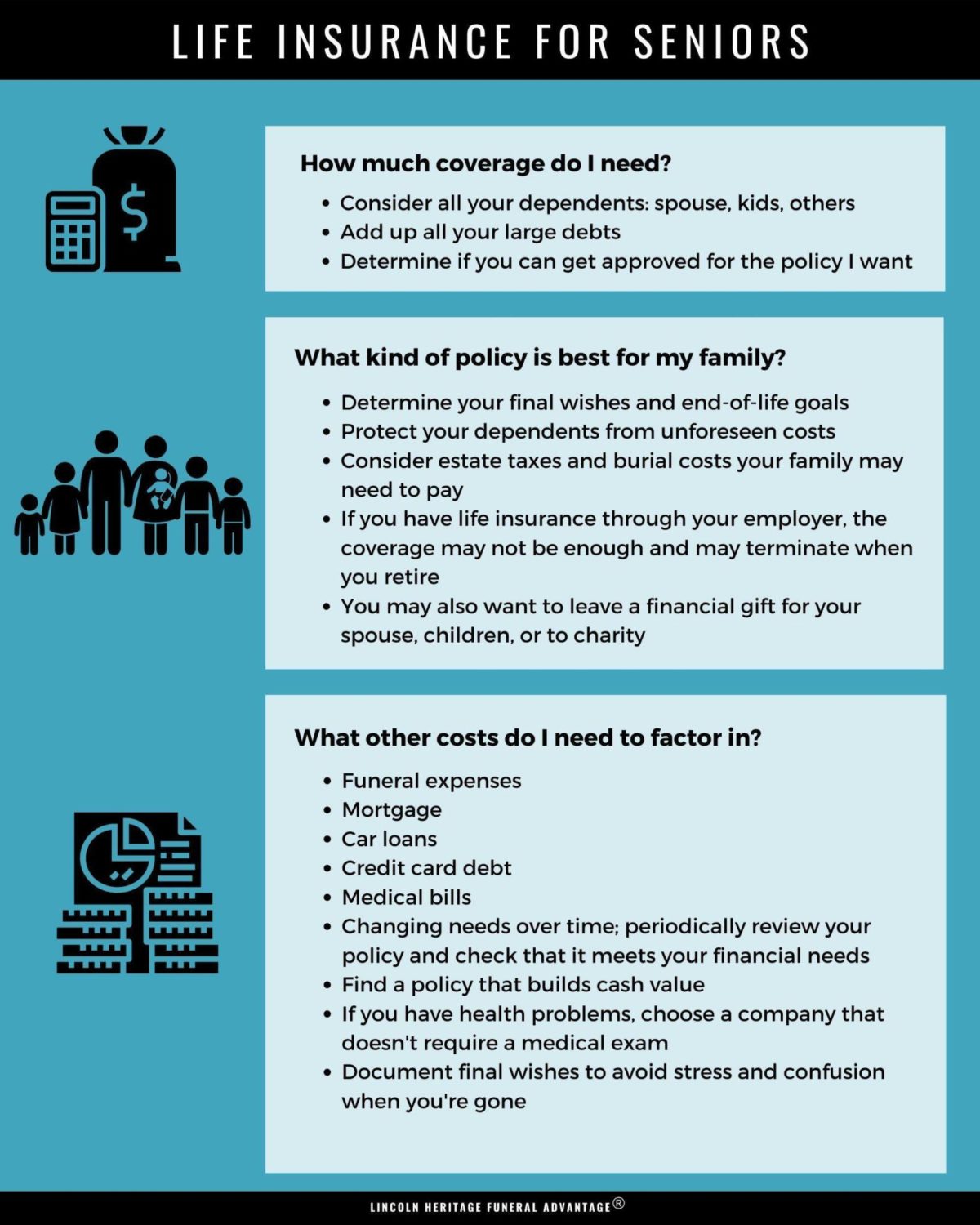

As such the death benefits element is crucial when you calculate life insurance cash value. Determine the term life insurance amount per thousand on a 23-year-old male for a 5-year policy given that the face value of the policy is 151625 and the annual premium is 39726. All types of permanent life insurance policies are eligible for a life settlement if the insured person is over the age of 65 and the face value of the policy is greater than 100000.

The face value of a life insurance policy is the death benefit. The face value of your life insurance policy is your death benefit -- the amount of money that you will leave your beneficiary should you die. To determine the face value of your policy review it.

According to Statista almost 54 people owned a life insurance policy in 2020 with an average coverage amount of 460000. Round your answer to the nearest cent. The IRS defines fair market value to be the price at which property would change hands between a willing buyer and a willing seller.

To calculate your life insurance coverage needs. So what makes your policy more valuable. Term life insurance does not have a cash value.

In determining your net worth you need to properly account for the value of your life insurance. For example a policy with a face amount of 1 million will be much more valuable than one with a face amount of 100000. As you are 65 years old now the cost of insuring your life is much higher.

The figure of people depending on. A face amount can change under certain circumstances such as when someone performs a face amount reduction for the purpose of. The face value of a life insurance policy is also called the death benefit.

The face amount of current life insurance policies does not count toward your net worth but the cash value of policies and all inherited death benefits do count toward your net worth. As you continue to pay your premiums a percent of the payments goes to your death benefits. For any life insurance policy the face value is the death benefit.

Face amount how much the policy will pay to the beneficiary if you were to die. When you first purchase your insurance plan its face value is usually your death benefits.

We Find It Easy To Justify The Insurance Cost For Our Cars Or Cell Phones And We Shrug Away Life Insurance Quotes Life Insurance Facts Life Insurance Policy

What Does It Mean For A Life Insurance Policy To Mature Life Ant

What Is Life Insurance And How Does It Work Money

How Does Whole Life Insurance Work Costs Types Faqs

17 Best Life Insurance Companies Of August 2021 Money

Understanding The Life Insurance Medical Exam Policygenius

If He Or She Dies Within The Term Of The Policy The Life Insurance Business Will Pay The Beneficiary Money Management Advice Financial Quotes Money Management

How Does Life Insurance Work Forbes Advisor

Life Insurance Over 70 How To Find The Right Coverage

Best Life Insurance For Seniors

Given This Sample Life Insurance Policy 1 A To Chegg Com

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

3 Ways To Generate Life Insurance Leads Life Insurance Sales Life Insurance Facts Life Insurance Marketing

Form Of Application For Life Insurance

Insurance Is The Champion Of Taking Care Of Your Family Financial Needs Life Insurance Quotes Life Insurance Life Insurance Marketing

What Is Term Life Insurance And How Does It Work Money

The Ins And Outs Of Life Insurance Policy Ownership Coastal Wealth Management

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Post a Comment for "Determine Face Value Of A Life Insurance Policy"