Extended Term Insurance Cash Value

Cash value life insurance is a form of permanent life insurance that features a cash value savings component. So you cant cash out term life insurance7 oct.

Life Insurance Loans A Risky Way To Bank On Yourself

The policy is usually a whole life policy but can originate from other cash value plans.

Extended term insurance cash value. The extended term insuranceoption differs from the reduced paid-up insurance option as it does not allow the policy to continue to earn interest increase cash value or pay dividends if dividends are applicable. Here is an example. Well focus on extended term insurance since it the most commonly used non-forfeiture option.

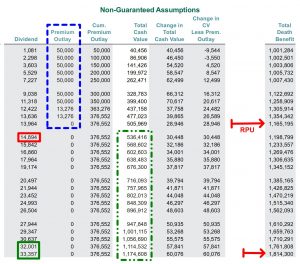

The amount of cash value you will have built in your policy will be reduced by the amount of any loans against it. Extended term life insurance is coverage that is provided by the cash value in a life insurance policy. You have a 100000 whole life policy that has built up some cash value.

Extended term insurance is a nonforfeiture option on a whole life policy that uses the policys cash value to buy term insurance for the current whole life death benefit for a specified period of time. Not The Same as Extended Coverage This is not to be confused with extended coverage a term used in the property insurance business. In this case you would forfeit your life insurance for the cash value that has built up in the policy.

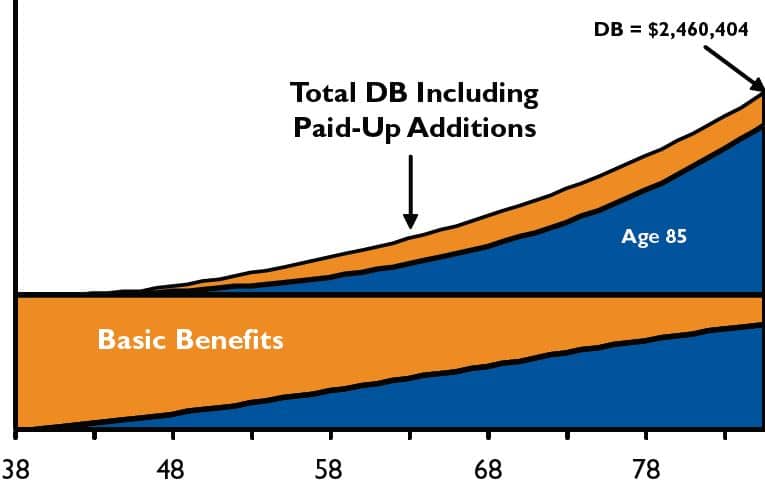

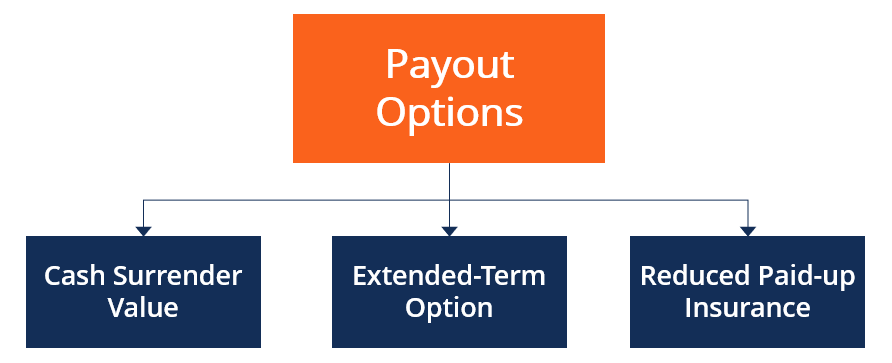

The three non-forfeiture options are cash reduced paid up insurance and extended term insurance. It does however allow the face amount of the policy to remain the same for a specified period of time. The guarantee is the cash value currently in the whole life policy.

Whole life insurance which is also called permanent life insurance offers a death benefit and also accumulates cash value you can borrow against or use for other purposes. Term life insurance expires once the term is up and doesnt build cash value but other types of life insurance last for life and do offer a cash value component. The amount of cash value you will have built in your policy will be reduced by the amount of any loans against it.

Extended term insurance Cash value surrender is the most basic nonforfeiture option that is available. The policyholder can use the cash value for many purposes such as a source of loans or. The extended term insurance option guarantees the policy owner the current death benefit of the whole life policy for a guaranteed number of years with no premium payment required.

Extended term insurance is life insurance is a life insurance policy where the policy holder stops paying the premiums but still has the full amount of the policy in effect for whatever term the cash value permits. Insuranceopedia Explains Extended Term Insurance Extended term insurance allows policyholders to stop paying premiums once the cash value. The amount of cash value you will have built-in your policy will be reduced by.

At the end of your term coverage will end and your payments to the insurance company will be complete. What happens to my premiums when the policy expires. A cash value feature in life insurance typically earns interest or other investment gains and grows tax-deferred.

Under an extended term nonforfeiture option the policy cash value is converted to The same face amount as in the whole life policy What life insurance policy would be considered interest sensitive. The feature primarily seeks to help those who find themselves in a situation where the whole life premium is no longer affordable. When a policy owner wants to stop paying required premiums it is one of the alternatives to surrendering the coverage for its cash value.

Only permanent life insurance policies have a cash value which can be used to take out a loan surrendered for cash or used to pay premiums. With cash value life insurance. But term life policies typically dont build cash value.

Before issuing the cash value payment to you any outstanding loans or premiums owed would be deducted by your insurer. What happens to money at end of term life insurance. Because term life insurance policies do not have a cash value they are about five - 15 times less expensive than permanent policies that have a cash value component.

Extended Term Insurance is not another form of Insurance as many people think but it is an option in a Whole Life Insurance PolicyFor those who dont know what a Whole Life Insurance Policy is that it gives a death benefit and a cash value based upon fixed premiums that is paid by the customerUnlike Term InsuranceWhole Life Insurance has both a Cash Value Benefit and a Death. Well focus on extended term insurance since it the most commonly used non-forfeiture option. An Extended Term Option is one of the standard nonforfeiture options in cash value policies.

The three non-forfeiture options are cash reduced paid up insurance and extended term insurance. Extended-term insurance allows a policyholder to quit paying the premiums but not forfeit the equity of their policy.

Limited Pay Whole Life Insurance Best Policies With Sample Rates

Life Insurance Loans A Risky Way To Bank On Yourself

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Automatic Premium Loan Provision The Insurance Pro Blog

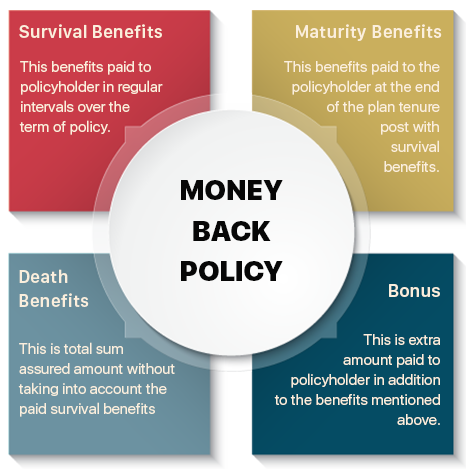

Money Back Policy Compare Money Back Plans Features Reviews

Limited Pay Life Insurance Everything You Need To Know

Transamerica Life Insurance Review Policies Pricing

Ladder Life Insurance Review Quick And Simple Coverage You Can Manage Online Valuepenguin

How Much Life Insurance Cover Do I Need Moneysupermarket

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Limited Pay Life Insurance Everything You Need To Know

Life Insurance Loans A Risky Way To Bank On Yourself

Term Vs Whole Life Insurance Policygenius

Nonforfeiture Clause Overview How It Works Payout Options

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Term Vs Cash Value Life Insurance Coastal Wealth Management

Nonforfeiture Options Of Whole Life Insurance The Insurance Pro Blog

Post a Comment for "Extended Term Insurance Cash Value"